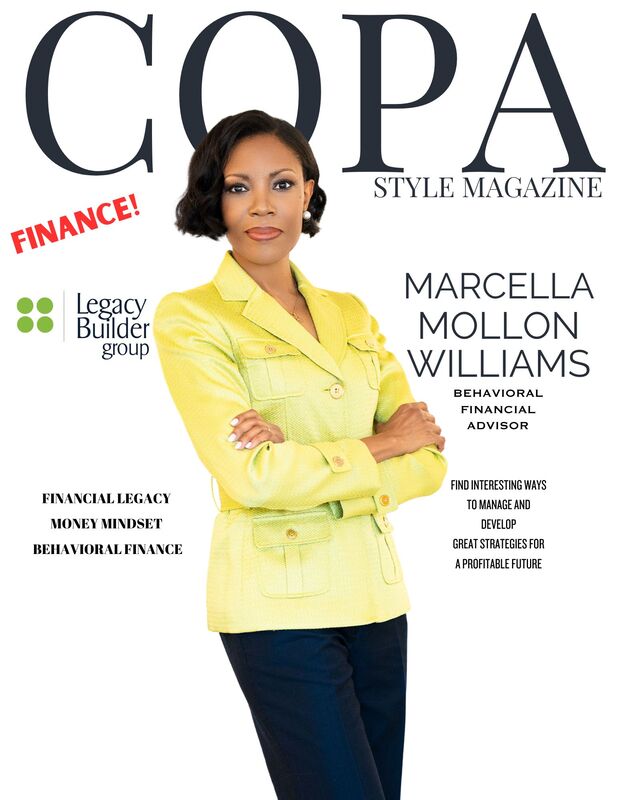

Marcella Mollon-Williams, BFA

~ Legacy Building ~

|

Copa: Where are you from?

Marcella: I was born in Trinidad and Tobago and migrated to the US when I was two years old. I grew up in Maryland, Washington, DC area. Copa: Which schools have you attended?

Marcella: I graduated from Bowie State University with a degree in Business and Finance. I went on to get my Behavioral Financial Advisor designation and certifications in Cognitive Behavioral Technique, Rational Emotive Behavioral Technique and Emotional intelligence. I am also a Certified Flexibility Coach. Copa: Why are family, fitness, and faith the main elements to success in life?

Marcella: These are what I refer to as Legacy Pillars. They are the foundational areas of our life experience and our greatest areas of influence on others. When these areas are fortified by operating in alignment with our core values, we are able to find more stability and purpose in our everyday lives and lead an effective legacy. Copa: In your professional opinion, can we resolve most of our financial problems with a change of behavioral changes?

Marcella: Absolutely. Most of our financial problems start with our money mindset and our mindset drives our behavior. A change in behavior starts with a shift in your money mindset. |

Copa: At what time did you begin to focus on your finance behavior and why is it so important to everyone?

Marcella: I've been fascinated with human behavior since I was a child so some aspects of behavior played a part of my 14 year financial coaching and investment practice. As the financial industry began to acknowledge the behavioral economic research that is conducted, it made room for people like me to tap into our desire to merge psychology and financial planning. This is important because our financial behavior, particularly when it comes to investing, negatively impacts our financial goals. It's not the markets by itself or the economy that deters our long term objectives, it is how we respond to economic situations. |

Copa: How important is a regular fitness ritual important to how we view everything in our lives on how we make choices?

Marcella: I am a strong believe that how you do one thing is how you will do anything. So whether we are talking about fitness or finance, what matters most is developing the discipline to guide us towards consistent action. I use my Behavioral Finance, flexibility fitness and mindset expertise to do one thing, teach you how to develop the behavior that will determine how other people will experience your existence.

Marcella: I am a strong believe that how you do one thing is how you will do anything. So whether we are talking about fitness or finance, what matters most is developing the discipline to guide us towards consistent action. I use my Behavioral Finance, flexibility fitness and mindset expertise to do one thing, teach you how to develop the behavior that will determine how other people will experience your existence.

Copa: Should we create a financial legacy for our children and why do most children don't understand the real value of money and its uses?

Marcella: Let's start with this..... A good man leaves an inheritance to his children's children (Proverbs 13:22). So the answer is yes. An inheritance is a financial legacy. The problem is that we stop there. An inheritance by itself can destroy a person, a legacy elevates a family. Many children struggle to understand the value of money and its uses because money conversations are not happening in many homes. Then, they become adults who struggle to understand their purpose for money. That cycle will travel from generation to generation until someone has the courage to break the No Talk Rule. The No Talk Rule is an unspoken agreement among family members that a particular topic will not be discussed. In this case, money.

Focus on the overall legacy, not just financial. This includes establishing a system to preserve the family intellectual assets just as much as the financial assets.

Marcella: Let's start with this..... A good man leaves an inheritance to his children's children (Proverbs 13:22). So the answer is yes. An inheritance is a financial legacy. The problem is that we stop there. An inheritance by itself can destroy a person, a legacy elevates a family. Many children struggle to understand the value of money and its uses because money conversations are not happening in many homes. Then, they become adults who struggle to understand their purpose for money. That cycle will travel from generation to generation until someone has the courage to break the No Talk Rule. The No Talk Rule is an unspoken agreement among family members that a particular topic will not be discussed. In this case, money.

Focus on the overall legacy, not just financial. This includes establishing a system to preserve the family intellectual assets just as much as the financial assets.

Copa: What's the best way we can create great examples of financial responsibility to our youth?

Marcella: The best example of financial responsibility should start at home through money conversations. From there, getting our kids involved with financial literacy programs.

Marcella: The best example of financial responsibility should start at home through money conversations. From there, getting our kids involved with financial literacy programs.